You might remember the housing crash in 2008, even if you didn’t own a home at the time. If you’re worried there’s going to be a repeat of what happened back then, there’s good news – today’s housing inventory shows a crash isn’t on the horizon. That’s because the market now is very different from 2008. This is something we recently wrote about, but now, we will take a much closer look at how housing inventory impacts today’s market.

One important reason a market crash isn’t anticipated is that there aren’t enough homes for sale. That means there’s an undersupply, not an oversupply like the last time. For the market to crash, there would have to be too many houses for sale, but the data doesn’t show that happening.

Housing supply comes from three main sources:

- Homeowners deciding to sell their houses

- Newly built homes

- Distressed properties (foreclosures or short sales)

Here’s a closer look at today’s housing inventory to understand why this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

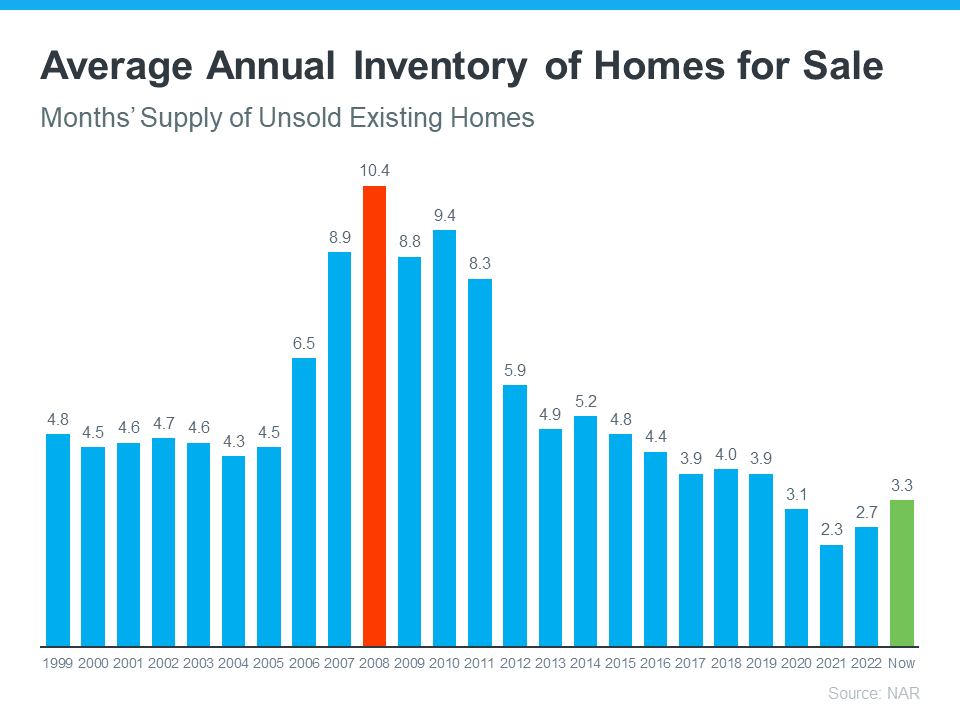

Although the housing supply did grow compared to last year, it’s still low. The current month’s supply is below the norm. The graph below shows this more clearly. If you look at the latest data from the National Association of Realtors (shown in green), compared to 2008 (shown in red), there’s only about a third of that inventory available today.

So, what does this mean for you? There just aren’t enough homes available to make home values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that’s not happening right now.

Newly Built Homes

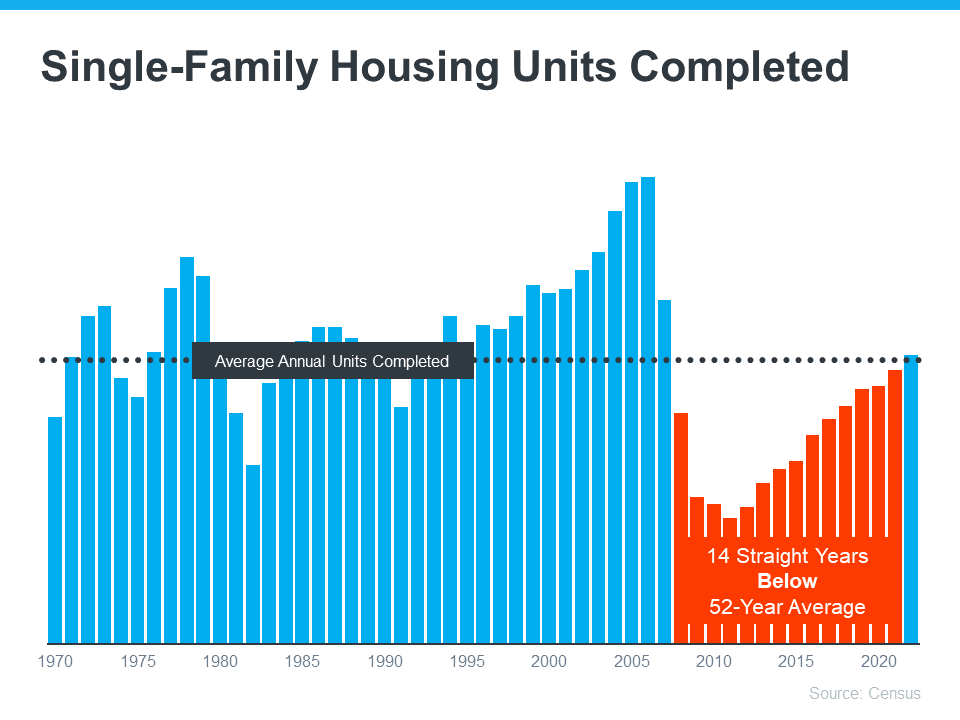

People are also talking a lot about what’s going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. The graph below shows the number of new houses built over the last 52 years and reveals 14 straight years of underbuilding:

The 14 years of underbuilding (shown in red) is a big part of the reason why inventory is so low today. Basically, builders haven’t been building enough homes for years now and that’s created a significant supply deficit.

While the final blue bar on the graph shows that home building’s ramping up and is on pace to hit the long-term average again, it won’t suddenly create an oversupply. That’s because there’s too much of a gap to make up. Plus, builders are intentionally not overbuilding homes like they did during the bubble.

Distressed Properties (Foreclosures and Short Sales)

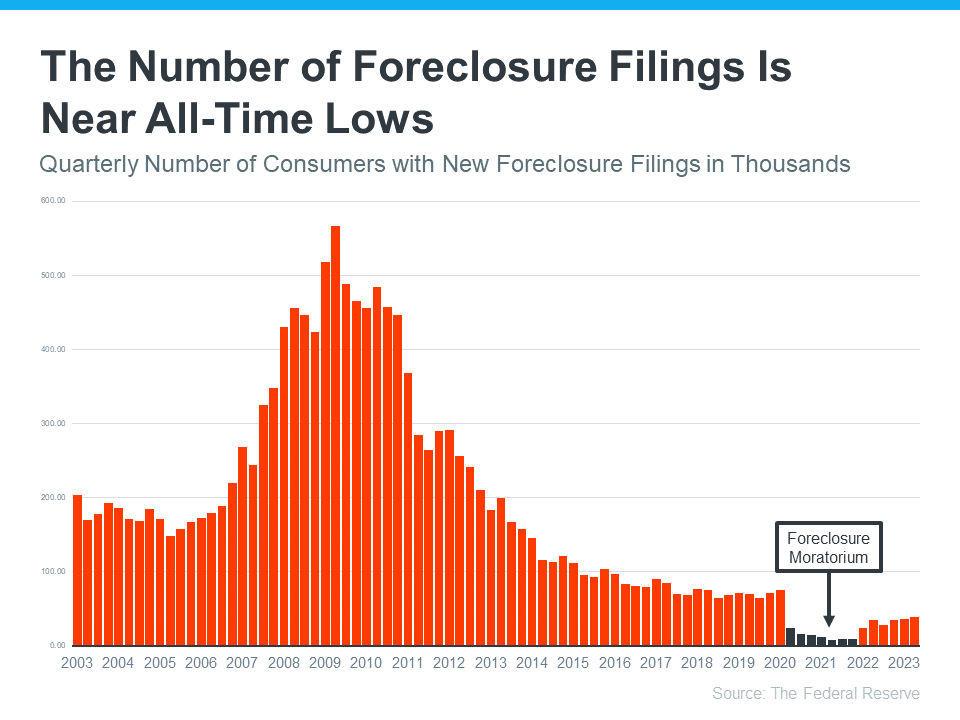

The last place inventory can come from is distressed properties, including short sales and foreclosures. Back during the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get home loans they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from the Federal Reserve to show how things have changed since the housing crash:

This graph illustrates, that as lending standards got tighter and buyers were more qualified, the number of foreclosures started to go down. In 2020 and 2021, the combination of a moratorium on foreclosures and the pandemic forbearance program helped prevent a repeat of the wave of foreclosures we saw back around 2008.

The forbearance program was a game changer, giving homeowners options for things like loan deferrals and modifications they didn’t have before. And, data on the success of that program shows four out of every five homeowners coming out of forbearance are either paid in full or have worked out a repayment plan to avoid foreclosure. These are a few of the biggest reasons there won’t be a wave of foreclosures coming to the market.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. According to Bankrate, that isn’t going to change anytime soon, especially considering buyer demand is still strong:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing inventory tells us there’s no crash on the horizon and houses continue to retain, and increase, their value. If you want to learn more about housing inventory in our area we should connect.